Investment trends

Quarter after quarter we’ve seen activity in the venture market go down. At least so it seems. Simultaneously, we are wondering what’s happening behind the scenes. Looking into numbers, pessimism mostly prevails.

By Sara Myrenfors, Investment manager, Schibsted

Investment trends

Quarter after quarter we’ve seen activity in the venture market go down. At least so it seems. Simultaneously, we are wondering what’s happening behind the scenes. Looking into numbers, pessimism mostly prevails.

By Sara Myrenfors, Investment manager, Schibsted

Do we see light at the end of the tunnel yet?

In hindsight, it is easy to see how boosted the VC market was a few years ago. High valuations and intense competition among investors were two of the main challenges experienced by VCs. Today, we are seeing a totally different VC market. There is a significantly lower pace of new investments with several VCs experiencing difficulties in finding co-investors and receiving considerably fewer investment proposals.

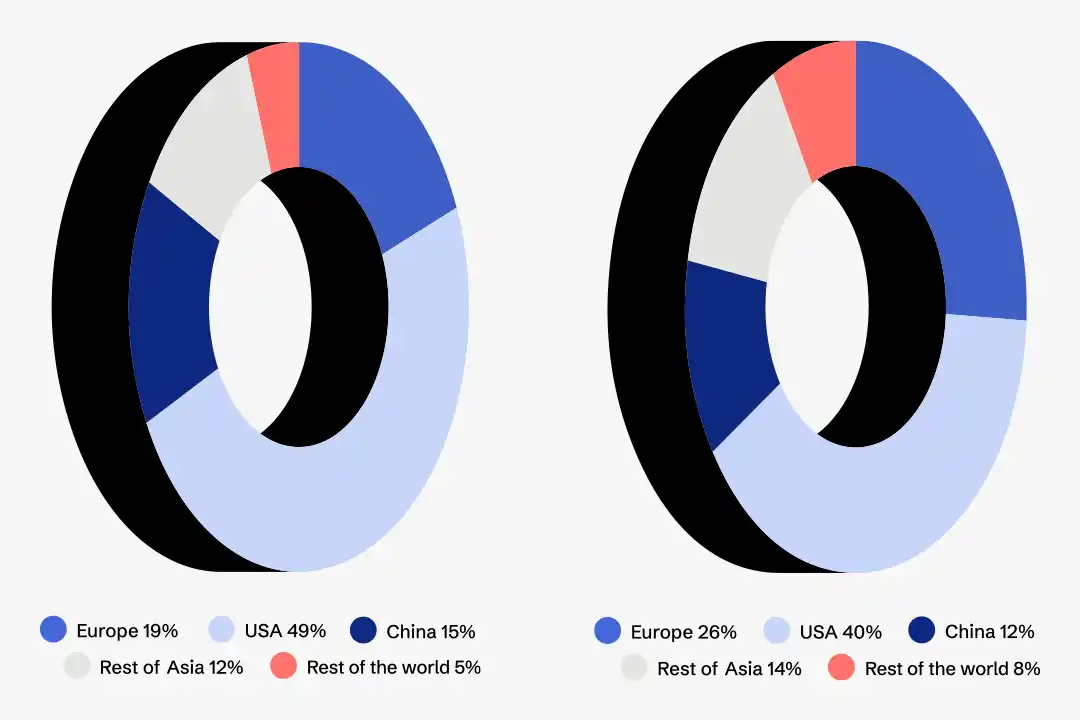

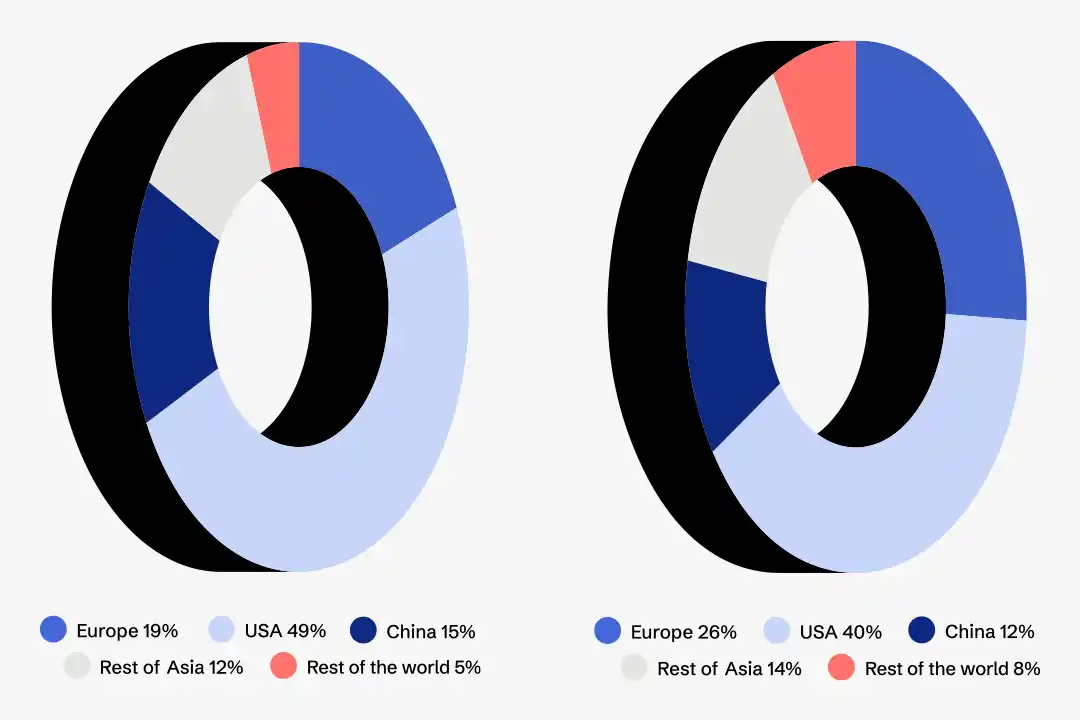

Left: VC investment seed stage per geography (company location) YTD 2023 (Q3). Right: Total VC investments per geography (company location) YTD 2023 (Q3)

Left: VC investment seed stage per geography (company location) YTD 2023 (Q3). Right: Total VC investments per geography (company location) YTD 2023 (Q3)

Even if many of the European VC market sentiments deteriorated further this year, the expectations for the next twelve months have improved. However, the confidence of fund managers in the long-term growth prospects is at an all-time low since 2018. This is largely explained by the current macroeconomic and geopolitical situation making both fundraising and exits challenging.

11 new European unicorns were born in the first three quarters of 2023, three of them in Q3.

11 new European unicorns were born in the first three quarters of 2023, three of them in Q3.

Zooming in on the Nordics, Sweden is starting to lose its dominance. The reason for this could be because the Swedish VC scene is more mature and most declines have been in later financing rounds. Instead Norway and Denmark have gained ground. Will the current climate be a reboot to a more even Nordic VC market, or will it scare off many new investors in the VC space? Time will tell. But a continuous cyclical development is the only thing we know for sure.

Most countries are back to 2019 levels of activity, with some exceptions like France (+37%), Denmark (+72%), Norway (+181%) and Italy (+57%), venture investment in H1 2019 compared to H1 2023.

Most countries are back to 2019 levels of activity, with some exceptions like France (+37%), Denmark (+72%), Norway (+181%) and Italy (+57%), venture investment in H1 2019 compared to H1 2023.

Activity levels same as in 2019

Most countries are back to 2019 levels of activity, with some exceptions like France (+37%), Denmark (+72%), Norway (+181%) and Italy (+57%), venture investment in H1 2019 compared to H1 2023.

3,4 trillion USD is the combined value of Europe’s tech ecosystem.

3,4 trillion USD is the combined value of Europe’s tech ecosystem.

11 new European unicorns was born in the first three quarters of 2023, three of them in Q3.

77 billion USD is the value of expected investment in European startups 2023 (well over the previous pre-pandemic record).

[Sassy_Social_Share]